Auto Policy Quotes vs Full Coverage: What’s the Real Difference? sets the stage for a detailed comparison between these two crucial aspects of insurance. Dive into a world of insurance intricacies where we unravel the distinctions between auto policy quotes and full coverage in a manner that is both informative and engaging.

Delve into the nuances of insurance choices and understand how they impact your coverage and costs.

Understanding Auto Policy Quotes

When shopping for auto insurance, one of the first steps is to obtain auto policy quotes. These quotes provide an estimate of how much you can expect to pay for coverage based on your specific details and needs.Auto policy quotes are calculated based on various factors that insurance companies consider when determining your premium.

Some of the key factors that influence auto policy quotes include your age, driving record, type of vehicle, location, and coverage options selected.

Types of Auto Policy Quotes

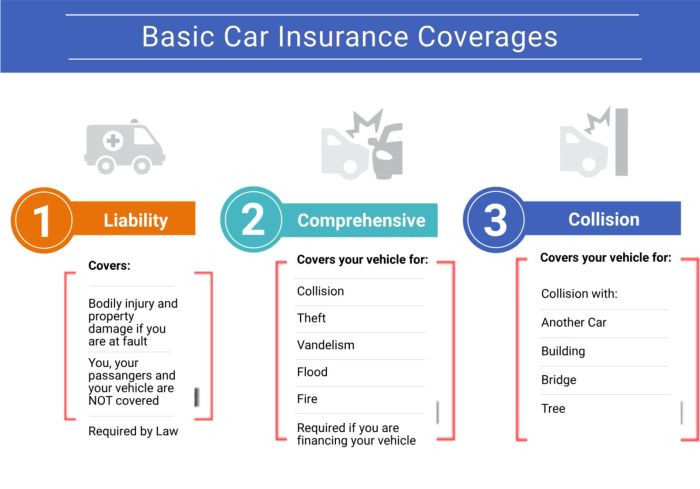

- Basic Liability Coverage: This type of auto policy quote provides the minimum required coverage by law and typically includes bodily injury and property damage liability.

- Full Coverage: Full coverage auto policy quotes include comprehensive and collision coverage in addition to liability coverage, offering more extensive protection for your vehicle.

- Customized Quotes: Some insurance companies offer the option to customize your coverage based on your specific needs, allowing you to add or remove coverage options to tailor your policy.

Exploring Full Coverage Insurance

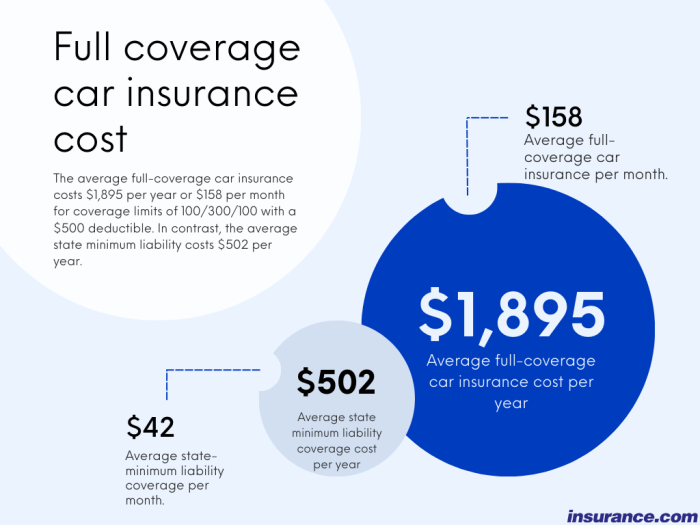

When it comes to auto insurance, full coverage is a term often used to describe a policy that provides a higher level of protection compared to basic liability coverage. Let's delve deeper into what full coverage insurance entails and why it may be beneficial in certain situations.

Components of Full Coverage Insurance

Full coverage insurance typically includes a combination of liability coverage, collision coverage, and comprehensive coverage.

- Liability Coverage: This component helps cover the costs of damages and injuries to others in an accident where you are at fault.

- Collision Coverage: This helps pay for repairs to your own vehicle in the event of a collision, regardless of fault.

- Comprehensive Coverage: This covers damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

Benefits of Full Coverage Insurance

Having full coverage insurance can be beneficial in several situations, such as:

- Driving a New or Expensive Vehicle: Full coverage can help protect your investment in a new or high-value vehicle by covering repair or replacement costs.

- Financing or Leasing a Vehicle: Lenders often require full coverage to protect their financial interest in the vehicle until it is paid off.

- Living in High-Risk Areas: Comprehensive coverage can be valuable in areas prone to theft, vandalism, or natural disasters.

Differentiating Auto Policy Quotes and Full Coverage

When it comes to auto insurance, understanding the key differences between auto policy quotes and full coverage is crucial for making an informed decision. Let's explore the distinctions to help you choose the right coverage for your needs.

Key Differences

- Auto Policy Quotes: Auto policy quotes typically provide basic coverage required by law, such as liability insurance. They are customizable based on factors like coverage limits, deductibles, and additional options like uninsured motorist coverage.

- Full Coverage Insurance: On the other hand, full coverage insurance includes comprehensive and collision coverage in addition to liability insurance. This type of coverage offers more extensive protection for your vehicle in various situations, such as accidents, theft, or natural disasters.

Cost Implications

- Auto Policy Quotes: Opting for auto policy quotes can be more cost-effective in terms of premiums since you're only selecting essential coverage. However, it may result in higher out-of-pocket expenses in the event of an accident or damage to your vehicle.

- Full Coverage Insurance: While full coverage insurance may come with higher premiums, it provides greater financial protection by covering a wider range of scenarios. It can help you avoid significant expenses for repairs or replacements in the long run.

Suitability Examples

- Auto Policy Quotes: If you have an older vehicle with lower value or you're on a tight budget, auto policy quotes may be suitable. This minimal coverage can fulfill legal requirements while keeping premiums affordable.

- Full Coverage Insurance: For newer or more valuable vehicles, full coverage insurance is recommended to safeguard your investment. It's also advisable if you live in an area prone to theft or severe weather conditions.

Factors to Consider When Choosing Between Auto Policy Quotes and Full Coverage

When deciding between auto policy quotes and full coverage insurance, there are several factors that individuals should take into consideration to make an informed decision. Personal circumstances and driving habits play a significant role in determining which option is best suited for each individual.

By analyzing these factors, individuals can design a decision-making framework to help them choose between auto policy quotes and full coverage effectively.

Cost

- Auto policy quotes typically offer lower premiums compared to full coverage insurance.

- Consider your budget and financial situation when deciding between the two options.

- Factor in the deductible amount and any potential out-of-pocket expenses in case of an accident.

Vehicle Value

- If you have an older vehicle with a lower market value, auto policy quotes may be a more cost-effective choice.

- For newer or more valuable vehicles, full coverage insurance can provide better protection in case of theft or accidents.

Driving Habits

- Consider your driving record and how frequently you use your vehicle.

- If you have a history of accidents or traffic violations, full coverage insurance may offer more peace of mind.

- For occasional drivers or those with a clean driving record, auto policy quotes could be a suitable option.

Personal Preferences

- Some individuals prefer the added security and comprehensive coverage that full coverage insurance provides.

- Others may prioritize cost savings and opt for auto policy quotes to meet their basic insurance needs.

Closing Notes

In conclusion, Auto Policy Quotes vs Full Coverage: What’s the Real Difference? sheds light on the key disparities between these insurance options, empowering readers to make informed decisions based on their unique circumstances. Navigate the insurance landscape with confidence and clarity.

FAQs

What factors influence auto policy quotes?

Auto policy quotes are influenced by various factors such as age, driving record, location, and type of vehicle. Insurers consider these factors to determine the risk profile of the driver.

Is full coverage insurance always more expensive than auto policy quotes?

Full coverage insurance tends to be more expensive due to the comprehensive nature of the coverage it provides. Auto policy quotes may offer lower premiums but with less coverage.

When is full coverage insurance beneficial?

Full coverage insurance is beneficial in situations where the driver wants extensive protection for their vehicle, especially in cases of accidents, theft, or natural disasters.

How do personal circumstances affect the choice between auto policy quotes and full coverage?

Personal circumstances like financial stability, driving habits, and the value of the vehicle play a significant role in deciding between auto policy quotes and full coverage.