Delve into the realm of car financing and discover why your credit score plays a crucial role in securing the best deals. Unravel the intricate connection between credit scores and favorable financing options as we explore this essential topic.

Learn how your financial history can impact the interest rates on your car loans and how a stellar credit score can empower you to negotiate better terms.

Importance of Credit Score

Having a good credit score is crucial when it comes to securing the best car finance options. Lenders use your credit score to assess your creditworthiness and determine the risk of lending you money.

Impact on Interest Rates

Your credit score plays a significant role in the interest rates you'll be offered on car loans. A higher credit score typically translates to lower interest rates, saving you money over the life of the loan. On the contrary, a lower credit score may result in higher interest rates, making the loan more expensive.

Negotiating Better Terms

With a good credit score, you have more leverage when negotiating terms for car financing. Lenders are more likely to offer you better deals, such as lower interest rates, higher loan amounts, or more favorable repayment terms. This can ultimately save you money and make the overall car buying experience more affordable.

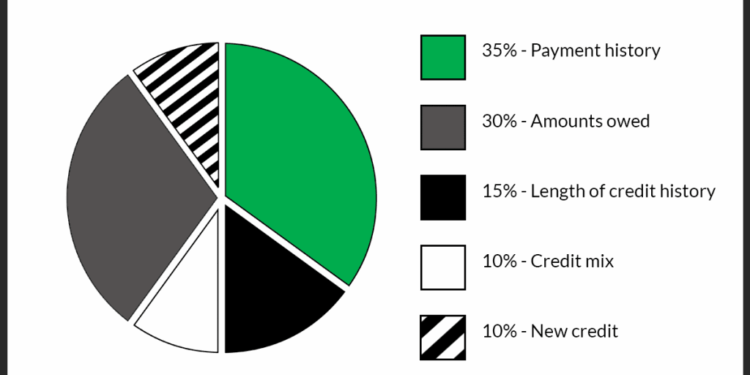

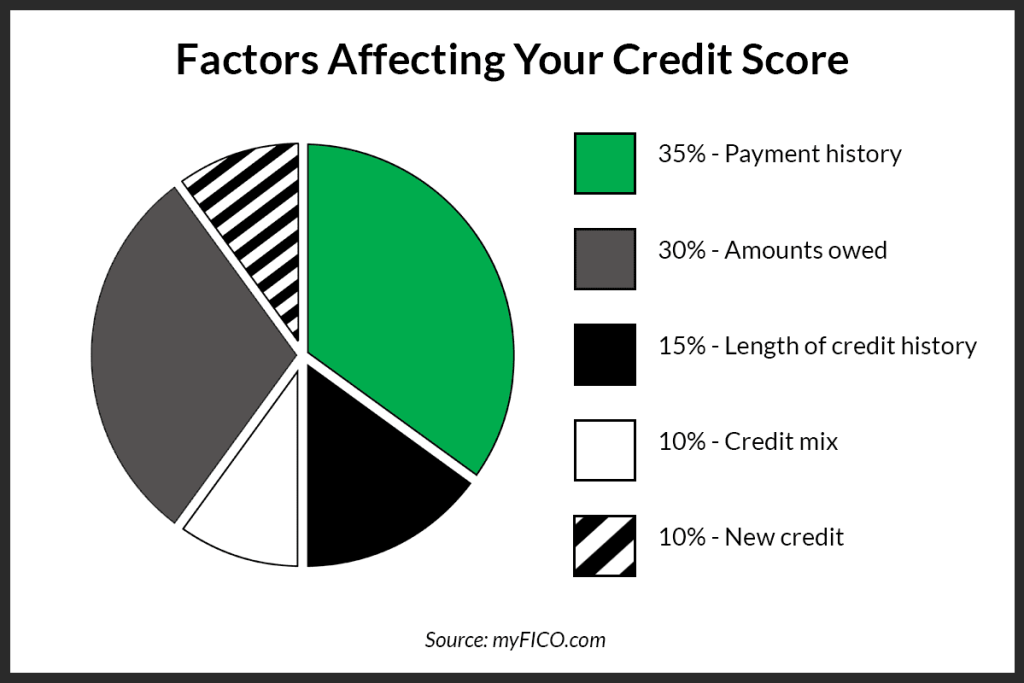

Factors Influencing Credit Score

Maintaining a good credit score is crucial when it comes to securing favorable car finance deals. Several key factors play a role in determining an individual's credit score, influencing their ability to access credit and the terms they are offered.

Payment History

A significant factor in determining credit scores is an individual's payment history. Lenders look at whether you have paid your bills on time, the frequency of late payments, and any accounts that have been sent to collections. Consistently making timely payments can have a positive impact on your credit score, while missed or late payments can lower it.

Credit Utilization

Credit utilization refers to the amount of credit you are using compared to the total amount available to you. Keeping your credit utilization low, typically below 30%, shows lenders that you are using credit responsibly and can positively impact your credit score.

High credit utilization, on the other hand, can indicate financial strain and may lower your score.

Credit History

The length of your credit history also plays a role in determining your credit score. Lenders look at how long you have been using credit and the age of your accounts. A longer credit history can demonstrate your ability to manage credit over time, potentially leading to a higher credit score.

Credit Mix

Maintaining a good mix of credit types, such as credit cards, loans, and a mortgage, can also impact your credit score. Having a diverse credit portfolio shows lenders that you can manage different types of credit responsibly. However, it is essential to only take on credit that you need and can manage effectively to avoid negatively impacting your credit score.

Access to Best Car Finance Deals

Having a high credit score can significantly impact the type of car finance deals you have access to. Lenders are more willing to offer favorable terms and lower interest rates to individuals with excellent credit histories.

Exclusive Offers and Discounts

- Loyalty discounts: Some lenders offer special discounts to customers with high credit scores who have a history of timely payments.

- Low or zero down payment options: Individuals with good credit may qualify for car finance deals with lower or no down payment requirements.

- Lower interest rates: A high credit score can help you secure a car loan with a lower interest rate, saving you money over the life of the loan.

Approval Process Impact

When applying for car financing, lenders consider your credit score as a key factor in determining your eligibility. A high credit score demonstrates to lenders that you are a responsible borrower, increasing your chances of approval for the best car finance deals available

Alternative Financing Options for Low Credit Scores

Individuals with low credit scores may face challenges when seeking traditional car loans. However, there are alternative financing options available to help them secure a vehicle.

Specialized Lenders for Low Credit Scores

Specialized lenders cater to individuals with low credit scores by offering car loans with different terms and conditions compared to traditional lenders.

- Specialized lenders may have higher interest rates to offset the risk of lending to individuals with low credit scores.

- These lenders may also require a larger down payment or collateral to secure the loan.

- However, specialized lenders are more willing to work with individuals with low credit scores and may provide a chance to improve credit through timely payments.

In-House Financing from Dealerships

Some dealerships offer in-house financing options for individuals with low credit scores, allowing them to purchase a vehicle directly from the dealer.

- In-house financing may have more flexible terms compared to traditional loans.

- Dealerships may be more lenient with credit requirements and offer competitive interest rates.

- However, individuals should be cautious of potential higher prices or fees associated with in-house financing.

Personal Loans or Credit Unions

Another alternative for individuals with low credit scores is to seek personal loans from banks or credit unions.

- Personal loans can be used to finance a vehicle purchase and may have lower interest rates compared to specialized lenders.

- Credit unions may offer more personalized service and assistance in securing a loan with a low credit score.

- Individuals should compare rates and terms from different lenders to find the best option for their financial situation.

Last Word

As we conclude our discussion on the significance of credit scores in car financing, remember that your credit score is not just a number—it's the key to unlocking the best car finance deals. Make informed decisions and watch your credit score pave the way for a brighter automotive future.

Helpful Answers

How does a good credit score impact interest rates on car loans?

A good credit score can lead to lower interest rates on car loans, saving you money over the life of the loan.

What are some alternative financing options for individuals with low credit scores?

Individuals with low credit scores can explore options like secured car loans or buy-here-pay-here dealerships.

Can a high credit score help in negotiating better terms for car financing?

Yes, a high credit score can give you leverage to negotiate lower interest rates or a longer repayment period.