Embarking on the journey of discovering the most affordable auto insurance with full coverage, this introduction aims to draw in readers with valuable insights and information presented in a clear and engaging manner.

Delve deeper into the intricacies of auto insurance coverage and learn how to secure comprehensive protection without breaking the bank.

Understanding Auto Insurance Coverage

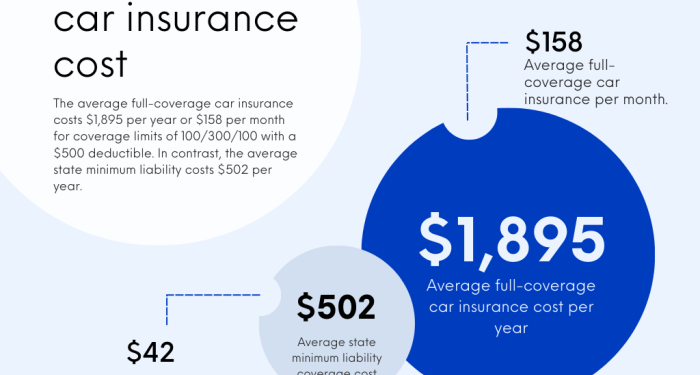

When it comes to auto insurance, understanding the different types of coverage available is crucial. One common option is full coverage auto insurance, which provides a comprehensive level of protection for your vehicle.Full coverage auto insurance typically includes three main types of coverage: liability coverage, collision coverage, and comprehensive coverage.

Liability coverage helps cover the costs of damages and injuries you may cause to others in an accident. Collision coverage helps pay for repairs to your vehicle in the event of a collision with another vehicle or object. Comprehensive coverage helps cover damages to your vehicle from non-collision incidents, such as theft, vandalism, or natural disasters.In comparison, liability-only insurance only includes liability coverage, which means it only covers damages and injuries you cause to others in an accident.

While liability-only insurance is typically cheaper than full coverage, it may leave you financially vulnerable if your vehicle is damaged in an accident that is your fault.

Comparison of Full Coverage vs. Liability-Only Insurance

- Full coverage auto insurance provides a higher level of protection for your vehicle compared to liability-only insurance.

- While full coverage may come with higher premiums, it can save you money in the long run by covering a wider range of potential damages.

- Liability-only insurance is more affordable upfront, but may not provide enough coverage in the event of an accident.

- Choosing between full coverage and liability-only insurance depends on your individual needs, budget, and level of risk tolerance.

Factors Affecting Auto Insurance Rates

When it comes to determining auto insurance rates, several factors come into play. These factors can vary depending on the insurance company, but some common elements that often influence the cost of auto insurance include personal factors, the type of vehicle being insured, and other individual considerations.

Personal Factors

- Age: Younger drivers, particularly teenagers, tend to have higher insurance rates due to their lack of driving experience and higher likelihood of accidents.

- Driving Record: A history of traffic violations or accidents can lead to increased insurance premiums as it suggests a higher risk for the insurance company.

- Location: Where you live can also impact your insurance rates. Urban areas with higher traffic congestion and crime rates may result in higher premiums compared to rural areas.

Type of Vehicle and Safety Features

- The type of vehicle you drive and its age can affect your insurance rates. Sports cars or luxury vehicles tend to have higher insurance costs compared to more economical models.

- Safety features such as anti-theft devices, airbags, and advanced driver-assistance systems can lead to discounts on your insurance premiums.

Credit Score and Insurance History

- Your credit score can impact your auto insurance rates. Generally, individuals with higher credit scores are seen as less risky to insure, resulting in lower premiums.

- Your insurance history, including any lapses in coverage or previous claims, can also affect the price you pay for auto insurance. A history of frequent claims may lead to higher premiums.

Shopping Around for the Best Rates

When looking for the cheapest auto insurance with full coverage, it is crucial to compare quotes from different insurance companies. This process can help you find the best rates that suit your budget and coverage needs.

Review Discounts and Bundling Options

- Make sure to review the discounts offered by each insurance provider, such as safe driver discounts, good student discounts, and multi-policy discounts.

- Consider bundling your auto insurance with other policies, like home or renters insurance, to potentially save more money.

- Ask about any additional discounts that may apply to you, such as discounts for having a clean driving record or for driving a vehicle with safety features.

Utilize Online Comparison Tools

- Take advantage of online comparison tools that allow you to input your information once and receive quotes from multiple insurance companies.

- Compare coverage options, deductibles, and premiums to find the most affordable full coverage auto insurance policy.

- Look for customer reviews and ratings to get an idea of the level of service provided by each insurance company.

Maximizing Coverage While Minimizing Costs

When it comes to auto insurance, finding the right balance between coverage and cost is crucial. By implementing certain strategies, you can maximize your coverage while minimizing your expenses.

Adjusting Deductibles

One effective way to manage costs while maintaining adequate coverage is by adjusting your deductibles. By choosing a higher deductible, you can lower your premiums. However, keep in mind that this means you'll have to pay more out of pocket in the event of a claim.

On the flip side, a lower deductible will result in higher premiums but less financial burden at the time of a claim.

Adding Optional Coverages

When opting for a full coverage policy, you may consider adding optional coverages such as roadside assistance, rental car reimbursement, or gap insurance. While these additions can enhance your protection, they also come with extra costs. Evaluate your needs and driving habits to determine if these optional coverages are worth the additional expense.

Negotiation Techniques

Don't hesitate to negotiate with your insurance provider to lower your premiums. You can inquire about discounts, bundle policies, or even switch to a different plan that better fits your budget. Being proactive and exploring different options can help you secure the best coverage at the most affordable rate.

Last Point

Concluding our discussion on finding the most economical auto insurance with full coverage, this summary encapsulates key points and leaves readers with a newfound understanding of securing optimal protection at minimal costs.

Expert Answers

What factors can influence auto insurance rates the most?

Personal factors like age, driving record, and location tend to have the most significant impact on insurance rates.

Is it better to have full coverage or liability-only insurance?

Having full coverage provides more extensive protection, but it comes at a higher cost compared to liability-only insurance.

How can I lower my auto insurance premiums?

You can lower your premiums by adjusting deductibles, taking advantage of discounts, and comparing quotes from different insurance companies.